Overall rating 4.5 stars

Visit httpss://blackbullmarkets.com

Introduction

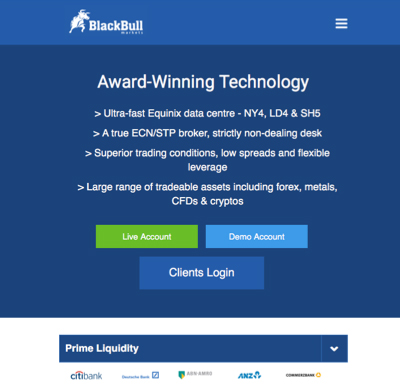

BlackBull Markets was founded in New Zealand in 2014, and they are registered with the Financial Services Provider Register as the broker’s regulator. BlackBull is able to operate in the European Economic Area as it has a presence in the United Kingdom as a registered UK company, with payment clearing done through BlackBull Group UK Ltd.

This BlackBull review will show that the broker provides a wide range of tradable instruments, with forex a key area together with six index-based CFDs and many energy and metals commodities. Currencies tradable in forex include major pairs and traders also have the flexibility to request access to a number of exotics and crosses. Cryptocurrencies are also offered, traded through CFDs, and include Bitcoin, Ethereum, Litecoin and DASH.

BlackBull only offers MetaTrader4 as its trading platform, but as it is considered to be one of the best platforms available, especially to those experienced in using it or its variants, traders should feel comfortable with it.

The broker offers four account types: Standard, Prime, Islamic and Institutional. The Standard account charges no commission with the Prime charging US$6.00 per Lot. The Institutional, which requires a minimum deposit of US$20,000, has a commission that can be negotiated with the company.

Products and trade offers info

BlackBull offers an extensive range of products that include forex pairs, CFDs and indices, commodities, metals and energy, as well as several cryptocurrencies.

Forex pairs: Operating 24 hours a day, five days a week, the broker offers the major forex pairs such as EUR/USD, GBP/USD, USD/JPY, USD/CAD, AUD/USD, NZD/USD and USD/CHF. BlackBull also offers many minor forex pairs including AUD/CAD, CAD/CHF, EUR/GBP and NZD/CAD. Access to the system is free of charge to clients, and there is full customer support during trading hours. Traders need to be aware that the forex market can be extremely volatile and subject to both political and economic announcements that can affect the direction of currencies.

CFDs and indices: Trading in indices is done through Contracts for Difference (CFDs) and gives traders more diversification of instruments they have access to. With indices being less volatile in general, as opposed to forex markets, they are utilised more to store wealth than to generate it.

Commodities: BlackBull clients have access to trading both soft and hard commodities. Soft commodities include agricultural products such as cocoa, livestock and sugar and can be quite volatile depending on bad weather affecting production or global food shortages. Hard commodities include precious metals, such as gold and silver, and energy products that include natural gas and light crude oil. Gold and silver are considered safe-haven investments whereas energy can be volatile depending on market conditions and supply decisions by major oil producers.

Cryptocurrencies: The broker gives access to trading a range of cryptocurrencies which are traded through CFDs. With Bitcoin, Litecoin and Ethereum available for trading, clients need to be aware that the crypto market can be very volatile.

| BlackBull pros | BlackBull cons |

|---|---|

| NDD environment | Lighter regulation in New Zealand |

| High leverage levels | No trading platform choice (MT4 only) |

| MT4 and variants available | Does not offer a web-based platform |

| Options for advance copy trading using AutoTrade | |

| No commission on Standard account |

Commissions and fee charges

As with any broker, commissions and fee charges will vary in relation to the type of account being used. Depending on what a trader wants, there are different requirements in terms of minimum deposits and spreads, but with all accounts, there is up to 1:500 leverage available. For those just starting out in the world of trading, BlackBull offers demos for all its accounts so clients can learn how finance operates and not risk their own money, to begin with. Demo accounts mirror most aspects of live accounts and can teach most of the basics needed to trade, but when moving to trade with real money, traders need to remember that there are high risks involved, especially when trading forex on margin.

Standard account

The Standard account gives access to all the broker’s tradable instruments with a low initial deposit. There are low spreads and no commissions making the account ideal for getting started in the trading business. The account can be used on desktops, laptops, tablets and smartphones as well as WebTrader.

Prime account

The Prime account offers a competitive edge for traders; spreads start at a low 0.2 pips and there is a commission of $3 per lot for each $100K traded. All tradable instruments are available, so traders can test out different markets and judge what level of investment risk they are comfortable with.

Islamic account

Islamic accounts are now offered by many brokers and operate a little differently than other accounts. Islam does not permit paying or receiving interest as BlackBull has developed a swap free account that is in complete compliance with Sharia Law. These accounts are offered by the broker as variants of all accounts offered; Standard, Prime and Institutional accounts retain all the features of regular account types. The Islamic account gives access to all the broker’s tradable instruments, allowing plenty of choice for traders in this field to develop effective portfolios.

Institutional account

This is an account for the broker’s largest traders and aims at providing an institutional experience through customised accounts. Traders using this account can tailor their spreads, commission and other aspects of trading to develop an account that suits their own preferred trading style. Clients can take advantage of a number of essential features to help their trading proceed as smoothly as possible, including:

Complimentary VPS access: this gives the option for using a combination of a dedicated server and shared hosting, allowing traders to have more flexibility than shared hosting alone, and getting access to more resources.

Customisable commission structures: the opportunity to negotiate commission when carrying out large trades is a useful option for traders who want flexibility and value for their money.

Dedicated technical support 24/6: professional traders often need answers to questions at any time of day or night during trading hours, making this an important feature provided by BlackBull with this account.

Customised MAM/PAMM platform: for money managers who want to send trades easily from a master account in a centralised hub to a sub-account, the MAM/PAMM software is available on the MT4 platform for institutional account holders.

Optional White Label branding: traders can opt for White Label branding so if they are developing their own products, they can put their brand on them and then sell the products to an end customer.

The range of account options available from BlackBull opens up opportunities for traders just starting out, for those who have gained experience and want more from their account, and also for the professional money managers who may be handling large trades both for themselves and for other clients.

What others say

A useful way to assess whether BlackBull Markets is an appropriate broker for traders is to look at what reputable forex broker review sites say about the company.

Forexbrokers.com states in their BlackBull review that the broker “provides trading in forex and CFDs through the popular MT4 platform under competitive terms and conditions.”The reviewer also states: “BlackBull Markets has partnered with MyFXBook to offer AutoTrade a platform, specialized in copy trading. The best part is that the broker does not charge any extra for auto trade.”BlackBull does provide competitive terms and conditions, and copy trading is a useful tool for those who want to use it.

There is high praise from forexfraud.com whose forex broker review says: “When all is said and done, BlackBull Markets stands as perhaps the most reputable broker we have reviewed thus far. The trading community just likes these guys and that is quite priceless. In fact, reputation could well be considered the main selling point of this operator.”With the financial world under constant pressure to show that is well regulated, and in the past there are many examples of things going wrong whether by omission or by fraud, reputation is key to attracting new clients. The BlackBull broker review also states “…we’re dealing with a well-regulated broker here, one that offers superb trading conditions and a great deal of flexibility leverage-wise as well as in regards to the assets it offers for trading.”As accolades go, this would be hard to beat.

There is more positivity about BlackBull from groundfinance.com, their BlackBull broker review stating: “BlackBull markets is an excellent broker (for) anyone who is serious about their trading. They offer everything you will ever need to be profitable in the financial markets.”The BlackBull broker review continues: ” The trading costs are lower than the average and you have plenty of options to move your funds in and out from your trading account.”The MT4 platform with its variants does indeed offer traders everything they might need for successful trading and the reviewer also mentions that the broker is “regulated by one of the toughest regulators in the world.”

Customer service

Good customer service is an essential part of running a successful business, as it is vital for keeping current clients because it is responsive, and it encourages new clients because it is known to look after people. Customer service is largely subjective and it often depends on the individual being served as to how successful that service is perceived.

BlackBull has a live chat option on its website to provide support, and if a support person cannot be reached, there is an email available – [email protected]. Phone numbers are available for the New Zealand head office and the support office in Malaysia. Support is available throughout trading hours, 24/5.

Individual reviewers have made a variety of comments that include “excellent support from customer service” from a client in Malaysia, “…their service is really good” from a UK client, and from a comment on myfxbook.com “They have excellent customer support…”.

In addition to the online and phone support, the broker hasa comprehensive FAQ page on its website with many articles explaining both basic and more complicated aspects of trading and opening accounts, as well as the opportunity to search for answers to questions by entering a search term. Popular articles include:

The FAQs also provide information on the history of the company as well as how to download MT4 for Windows, iOS and Android devices.

Awards can shed a useful light onto how a broker is seen in comparison to its competitors, and in 2018 BlackBull Markets won two awards:

Platform features and tools

BlackBull offers the popular MetaTrader4 (MT4) as its trading platform. It’s a user-friendly design that can easily be customised to a trader’s preferences so that trading experiences can be personalised. Features include interactive charts, instant execution of trades, technical indicators and many others. The broker’s platform connects traders to the NY4 Equinix server which is based on Wall Street and provides a reliable and exceptionally fast service. The server allows clients to trade directly with markets and a number of Prime Liquidity providers allow access to the best available bid/ask prices.

The MT4 platform also provides support for Expert Advisors (EA) so traders can look for a provider that utilises a strategy to suit the individual’s trading preferences. With thousands of paid and free advisors available, traders are able to work at different levels of risk and with varying profitability. The platform also gives support to MetaScript so traders can create their own EAs to suit their trading style.

Key MT4 features include:

MT4 is available for Windows, Macs and for iOS and Android mobile systems. Social Trading is also available through MyFxBook, PsyQuation and SwipeStox, and the platform offers a Virtual Private Server as well, so traders don’t have to be worried about their device turning off.

BlackBull does not currently provide a WebTrader service but is working on it, and though some traders may prefer to have an alternative to MT4, there is little doubt that the platform provides everything traders of all levels of experience will find good to use.

Mobile trading

The ability to work while on the move is now a normal part of what employers and employees expect in the wireless world, and the option to trade from anywhere in the world is an essential tool for traders. BlackBull provides mobile device options for both iOS and Android to be used with tablets and smartphones. In the early days of providing a mobile trading platform, there were concerns that they would not be full functionality, but that is in most cases no longer the situation.

The MT4 Android application, native to the OS platform, gives traders the full functionality they need so trading can be done easily from anywhere. If wireless connectivity is not available then data can be used provided there is a phone signal, and traders in more remote areas should make sure they have a large amount of data available in their package in case they need it.

The Android app gives traders a full set of orders, interactive charts and technical analysis capabilities. It also features an intuitive touch design with high res graphics designed for retina screens and customisable chart colour schemes, amongst others.

For iPhones and iPads, the i0S application is also available for MT4 trading and also offers full functionality with BlackBull Markets accounts. Traders can access a full set of trade orders and a complete trading history, together with interactive technical indicators, high-performance charts and analytical objects and tools. The app supports more than 20 different languages giving it an effective global reach.

The broker’s clients, using this mobile technology, get all the benefits of the MT4 platform and the ability to trade anywhere at any time when markets are open.

Robo trading

With markets open 24 hours a day, five days a week, it is impossible for traders to physically keep tabs on everything that is going on, especially if they are involved in several different markets. Robo trading has developed considerably over the last few years, allowing traders to auto-trade by setting up networks of traders to follow.

BlackBull lets traders sign up with social media entity Myfxbook that lets them set up auto-trading by following selected traders and also allows them to set themselves up in an auto-trading network as the main trader.

Traders can also use PsyQuation, an online robo-trading coach that is a machine-learning system that constantly analyses trades and trading behaviours. Weaknesses in trading strategies are uncovered, advice is given to mitigate negative effects, and traders can set trading goals and use PsyQuation to work towards them.

By setting the right parameters with robo-trading, suitable for a trader’s specific requirements, opportunities can be taken at any time of day or night. It offers tracking, so the trader can check on what is going on whenever they require, effective use of time and resources.

Research and learning section

Understanding how markets work is key to becoming a successful trader, as is having a clear grasp of the platform to be used. BlackBull provides a wide range of resources to assist traders, and these are especially useful for those relatively new to trading. Videos and webinars are available on the broker’s website and cover many of the complex areas of learning how to operate the MT4 system. Videos include:

In addition to these videos, the broker has a blog, though this does not appear to be updated regularly, and market analysis videos are also available.

The MT4 videos are a very useful addition to the learning tools that can be accessed and add considerably to the user experience.

Regulatory details

BlackBull Markets is registered and incorporated in New Zealand, registered with the FSPR (Financial Services Provider Registry and is a member of the FSCL (Financial Services Complaints Ltd), a dispute resolution scheme. The company has a strict AML/CFT (Anti-Money Laundering/Counter Financing Terrorism) policy and clients can be assured that there is a high standard of operational standards and corporate conduct, ensuring funds are safe and transactions are compliant with financial rules.

Our summary

Strong regulation and a commitment to transparency give BlackBull Markets a leading edge in the brokerage business in this forex broker review. Couple these aspects with the provision of the popular MetaTrader4 platform, its wide range of products covered and a reputation for excellent trading conditions, and traders will find the company offers attractive terms and conditions for doing business. With many positive reviews and plenty of options for mobile and robo-trading, this BlackBull review determines that BlackBull Markets is well worth considering as a trading enabler.