If you are interested in cryptocurrencies, then you need to have a basic understanding of the underpinning technology that drives the entire enterprise – Blockchain Technology. A simple definition from Wikipedia reads: “A blockchain, originally block chain, is a growing list of records, called blocks, which are linked using cryptography. Each block contains a cryptographic hash of the previous block, a timestamp, and transaction data. By design, a blockchain is resistant to modification of the data.” Did everyone understand that completely? Are you ready to be tested on this topic?

If you are a computer geek, then you might want to go elsewhere. The narrative to follow is meant for laymen investors and will only the scratch the surface of the technical blockchain infrastructure, touching upon the key aspects that make this software technique so unique. Some commentators have also gone so far as to say that blockchain mechanisms are not new. They simply built upon proven technologies, i.e., the Internet, private key cryptography, and a protocol governing incentivization, with decidedly new applications that offer innovative useful approaches for data sharing.

If you are a computer geek, then you might want to go elsewhere. The narrative to follow is meant for laymen investors and will only the scratch the surface of the technical blockchain infrastructure, touching upon the key aspects that make this software technique so unique. Some commentators have also gone so far as to say that blockchain mechanisms are not new. They simply built upon proven technologies, i.e., the Internet, private key cryptography, and a protocol governing incentivization, with decidedly new applications that offer innovative useful approaches for data sharing.

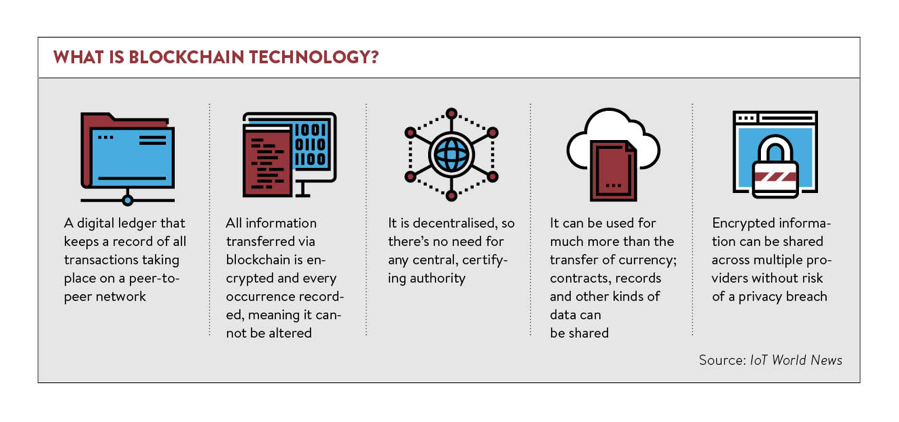

If you ponder for a moment the Wikipedia example, you have a centrally maintained master file that can be updated by users that access the file. Blockchains, however, are decentralized. Every server on the network updates its master file at the same time to record a new transaction. In other words, there is no need for a centrally controlled data management system. Anonymity arises when every transaction is recorded on the public ledger, but with no identifying data attached, a form of privacy that regulators abhor.

As one expert noted: “The result is a system for digital interactions that does not need a trusted third party. The work of securing digital relationships is implicit — supplied by the elegant, simple, yet robust network architecture of blockchain technology itself.” The excitement in financial circles is that this approach could be the next revolution on how transactions of all types are handled in a decentralized fashion.

Those in the know claim that blockchain records are incorruptible. In the Bitcoin experience, there have been many hacking compromises and eye-catching stories of losses in the millions, but the blockchain code is not at fault. Problems have resulted due to mismanagement, bad intentions, human error, poor judgment, and the lack of adequate security protocols. According to set formulas, the number of blocks in a blockchain system can grow over time. In the cryptocurrency world, miners, acting as auditors, can add to the blockchain by solving 64-digit-hexidecimal “puzzles”, thereby gaining a specified reward of new coins.

The key takeaway here is that the number of blocks is limited. Bitcoin, for example, has 17.3 million coins in circulation with an upper limit of 21 million. This limit cannot be increased unless system participants agree to do so, a process that has yet to be defined clearly. The point is that this arbitrary limit on supply helps to increase the value of a single coin when demand takes a pike up for any reason. On the other hand, miners can cause dilution, but there are annual limits on new blocks that can be created, and the reward is cut in half each year, as well.

Blockchain distributed ledgers are being used today, according to one reporter, “in everything from shipping to finance to food safety.” At some future crossroad, insiders expect some form of patent war to be waged. Cryptocurrency foundations are built upon open source code fundamentals. No patent is owned, but there are already 350 patents and thousands in the pipeline. Major companies, however, are thought to be moving to avert any possibility of a patent war, but time will tell.