Many of the world’s stock markets have enjoyed incredible gains since 1982. Investors have been pocketing steady, consistent returns for over three decades now.

In fact, with Trump’s US Presidential Election win, stock markets around the globe took off to all-time record highs in 2017. Then in 2018, they continued higher and higher, hitting record high after record high. Taking on short positions or delving into naked short selling during this time would have been challenging.

Given the roaring bull markets we’ve just witnessed, you may be forgiven for not wanting to learn about short selling or short positions.

Having said that, post-GFC stock markets have certainly had their share of rocky times.

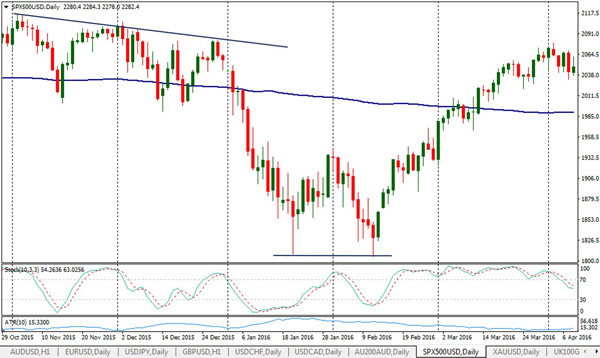

Active traders will remember clearly how ferociously stock markets fell at the start of 2016. You can see in the chart below, the S&P500 had successive lower highs and lower lows, as did the Dow Jones. But few would have guessed the market was about to have such a short, sharp fall in price.

It is during these rapid movements where traders stand to gain the most in the shortest amount of time.

Today we’re going to take a look at how to short sell stocks, indices or commodities using CFDs. We won’t be discussing Forex Trading Strategies as every FX position you are long one currency pair and short the other.

Since 2009, stock markets around the globe have been rising at a rapid pace.

Just take a look at the Three Indexes chart below, compliments of advisorperspectives.com. Data is up to February 28, 2018.

You will notice there have many few ‘blips’ to the downside during this period. Mind you, when you are compressing 16 years worth of data on one chart, it is easy to miss the small details.

Despite the impressive run prior to and including 2018, there have been several golden opportunities, as short sellers profit from strongly downtrending markets.

Short selling is the ability to profit as the stock, index, commodity or FX pair you are trading, is falling in value.

Short selling or to sell short, is where you take advantage of a fall in an instruments price.

Ideally, your goal is to make a profit as the instrument you are trading falls in value.

Traditionally short selling has been reserved for experienced traders. But since the advent CFDs and CFD trading, short selling is not only possible but very accessible for all traders.

Imagine it’s raining outside, and you need to get some lunch but you don’t have an  umbrella.

umbrella.

So you ask your work mate if you could borrow her umbrella and Krystal happily agrees.

Once downstairs you are approached by a suave looking guy in an Armani suit holding a bunch of papers (probably a lawyer!), and he doesn’t have an umbrella.

He asks if he can buy your umbrella.

Without a moment’s hesitation, you say ‘Yes, you can have it for $30’ and he happily agrees.

Problem:

You have just sold something you don’t own and there is a chance Krystal (the original owner) is going to get upset.

Solution:

You run through the rain to the nearest umbrella shop (is there such a thing?). You notice they are selling an identical umbrella to the one Krystal lent you. Even better news, it’s only $20.

So you happily pay the cashier $20. Without a moment’s notice, you discover you just made $10. Not only that, but Krystal (the original owner) has no idea, plus she’s going to get a brand new umbrella.

Who said there is no such thing as a free lunch?

Now you understand short selling.

Sorry for the stupid example but I’m sure you get the point.

Fortunately, when you short sell with CFDs you don’t have to find someone on the other side of the transaction (Krystal) willing to lend you the stock as your CFD broker will arrange that for you.

Most CFD brokers in Australian in 2018 will allow you to short sell the top 250+ stocks, so there are plenty of opportunities to choose from.

Let’s have a look at a trading example with some real numbers.

We’ll look to place a hypothetical short sell on the ASX stock APA Group with the goal to profit as it is sold short.

You will notice APA Group was in a downtrend in August and September 2016. Scanning for down trending stocks to short is sensible. You always want to be trading in the direction of the dominant trend where possible.

The best way to scan for stocks in a downtrend is using technical analysis. You may like to use Metastock, who use Reuters as their data providers.

Short Sell 1,000 APA share CFDs at $8.50 – Looking to profit from a falling share price.

| Action | How to calculate | Result |

| Total Exposure | 1,000 CFDs @ $8.50 | $8,500 |

| Initial Margin | $8,500 * 10% | $850 |

| Brokerage | Total exposure * 0.08% or $8 | $8.5 |

| Total Outlay | Initial margin + brokerage | $858.5 |

APA falls over a 34 day period to $7.52 and you lock in profits the day after APA hits your stop loss.

| Action | How to calculate | Result |

| Sell price | $7.52 * 1,000 | $7,520 |

| ~Brokerage | $7,520 * 0.08% or $9 | $8.00 |

| ^CFD Finance | Total Exposure * Relevant Bank Bill rate minus 2.5%. If the interbank rate is greater than 2.5%, you receive a credit. If it is below, then you receive a debit. So you don’t always get paid to be short a CFD position. | In this example, we will say the Bank Bill rate is 2.5%, so there is no credit or debit. |

Calculating your CFD Profit/Loss

| Action | How to calculate | Result |

| CFD Profit | (number of shares*(exit-entry)) – trading costs | |

| (1,000 * ($8.50 – $7.52 (profit)) – $16.5 (brokerage) + $0.00 (CFD Finance) |

||

| CFD Nett Profit/Loss | Profit $963.5 | |

| Return on Investment | (Nett Profit or Loss / Margin) * 100 | 113% |

So you can see from the example above, short selling is nothing more than selling the stock (CFDs in this case) first, then if and when it hits your stop loss, you buy it back (hopefully at a lower price).

Remember, working out your profit with contracts for difference (CFDs) is simply the difference between where you get in and where you get out, regardless of whether you trade long or short.

When short selling, your worst case scenario is the position moves higher and results in a loss.

When it comes to short selling safety, you must know that short selling has the potential for unlimited losses.

As a result, you must use stop losses when short selling CFDs or any other financial product (Forex, Indices or Commodities).

Smart short sellers and day traders would exit when their position hits their predefined stop loss.

To view an example of a short sell that resulted in a loss click here.

Before the rapid growth of contracts for difference (CFDs), people who wanted to short sell stocks had to find a full-service broker.

Unfortunately, this was mostly dominated by wealthy investors as the brokers would charge like a wounded bull.

Also, short selling stock via the ASX had the following restrictions:

To view the ASX short sell list or short selling reports updated for 2018, CLICK HERE.

Fortunately, traders no longer have such restrictive short-selling conditions.

Shorting stocks on the ASX and global equity markets is much easier thanks to CFDs. Also, there are two types of CFD brokers, which are market makers and Direct market Access or DMA brokers.

With most CFD Brokers, you can short sell the largest companies on nearly every global exchange. Short selling truly is as easy as hitting the sell button first and then closing the position by hitting the buy button.

There is no uptick rule, and margins for some CFD brokers are as low as 3%. This means you can short sell $10,000 worth of stock with only $300 of your money.

CFD brokers are not immune to the 10% short sale restriction imposed by the ASX. Fortunately, it is very rare to have an ASX stock go near the 10% of total stock being short sold.

As of 14 January 2018, the ASX short sell list had JB Hi-Fi having the largest amount of short sales at 0.75% of total stock on issue.

Over in the United States, there are no short sell restrictions. Therefore, traders and fund managers can short sell as many of the company’s stock as they like. This can lead to a short squeeze and Wall Street loves it.

Due to there being no short sell restrictions on stocks in the US, situations arise when stocks get hammered by the short sellers.

It might not look like much, but the SVU example on the New York Stock Exchange (NYSE) is one of the best short sell examples around.

The price plummeted from a high of $49.78 (not quite shown above) to lows of $1.68 as short sellers got very excited about driving this stock to zero. The fundamental analysis indicated things were not quite as they should be. So traders and hedge funds hit it hard.

A situation like this is ripe for a powerful short squeeze, which is exactly what happened.

While it is hard to see in the chart above, due to the vast time scale (weekly chart shown), the stock rose from the low of $1.68 to a high of $12.00. This is a short squeeze induced gain of 614 percent.

The only way to close your short sell position is to buy it back. What do you think happens when the majority of people on the stock are short and they need to close their position?

People run for the exits in every direction, buying stock back left right and centre. This is exactly what a short sell squeeze is. Notice how short selling provides liquidity to the stocks price?

Early 2008 in Australia saw the collapse of many well-established companies like ABC Learning Centres, Allco Finance and Babcock & Brown.

Hedge funds were blamed for their aggressive short selling, driving the price of the stock down to record lows. Eventually, they were delisted.

Fueling the fire was the fact the business loans were tied to the capitalisation of the company. As the share prices started to drop, company directors had to sell stock to free up their margin calls.

A beautiful cascade in the share price then unfolded. What happened next was the owner of the company, Eddie Groves, had to work for the company he built as an employee. Only this time he didn’t own the Brisbane Bullets or the shiny red Ferrari.

Every trader should learn the skills to short sell stock, indices or commodities. It should be part of your trading ‘toolkit’ so to speak.

Here are some of the top benefits of short selling stocks on the global markets.

Just to prove a point that stocks can go up beyond expectations, take a look at Warren Buffet’s company Berkshire Hathaway.

Imagine thinking at $50,000 this stock cannot go up any further and ignoring your stop loss.

You would want to have deeper pockets than Warren Buffett to ride out this exceptional move higher.

There you have the key details on what is short selling, how to short sell and a short selling example or two. Consider this your short selling guide if you like.

Good luck with your trading.