Ever since Bitcoin went live in 2009 with the first cryptocurrency transaction, the path of this new digital medium has been rocky, turbulent, and far from being a going concern. But the times, they have changed. Cryptocurrency pioneers persevered attacks from banks, government officials, and regulators across the globe. Although many of these attacks continue, the investment community has seized upon this new medium. The exchanges that process Buy/Sell transactions proliferate the marketplace, and although unregulated at this time, a vast majority would welcome the credibility that compliance could provide, as the industry sets it sights on institutional players.

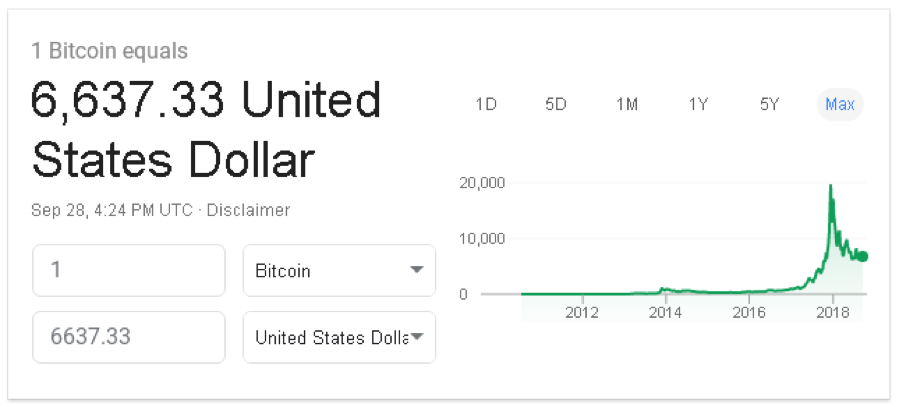

As recently as 2013, the CEO of Bitcoin, Anthony Gallippi, perhaps at the direction of his attorneys, had to admit in press interviews that there was an 80% chance that the value of a single Bitcoin could go to zero. In today’s litigious world, imagine the lawsuits from investors, if such an event had occurred and there had been no warning of the possibility of such a failure from management. Bitcoin survived, and its success has spawned more than a thousand competing brands, each trying to achieve a similar experience, as depicted in the Bitcoin valuation chart, as of September 28, 2018, presented below:

The value of Bitcoin never fell to zero, although it might appear so above, but it has risen to the heights of nearly $20,000, only to pull back to roughly 33% from that valuation peak. An asset bubble has come and gone for both Bitcoin and for its many competitors. How big is Bitcoin today? There are 17.3 million coins in circulation, which translates to a market cap of $115 billion using today’s valuation, anything but shabby.

The rush to buy was ignited in the investment community during 2017. Investors flocked to buy, but available supplies were limited, a unique design feature of cryptocurrencies that accounts for the extremely volatile price action witnessed above. Cryptocurrencies have actually been labeled recently as the most volatile asset class in history. Risk demographics are extremely high. Caveat Emptor!

Cryptocurrencies are another form of a digital asset, only these assets utilize an elaborate cryptography protocol within its online software platform, generally referred to as blockchain technology. For a user, it is very similar to online banking. You have an account and login credentials (private keys in this environment), and the online ledger system keeps track of your balance and related transactions in the distributed crypto system. This system resides on many computers in the network, but unique software algorithms keep everything in balance. There is no need for a central clearing bank.

There is no central bank oversight either. There is no central trading floor where buy/sell transactions are exchanged. Exchanges are independent entities that act as market makers for each coin (‘token” in crypto parlance) product, if financially feasible for them. You may access your account through an exchange or a broker that may deal with several exchanges to get the best prices, much the same as when buying and selling stocks on a traditional stock exchange.

Since everything is online, various reporting companies can compile daily volume data for the crypto industry. If we only tally the “Top 3” U.S. players, i.e., Bitcoin, Ethereum, and Ripple, volume over the past 24 hours exceeded $8.1 billion. These coin systems are here to stay, judging by these significant volumes alone, but this figure is a far cry from daily turnover in the forex world, estimated to be over $5 trillion a day. It is also interesting to note that Apple on a good day trades only $4 billion, but crypto reporting groups currently have a credibility issue. Analysts insist they inflate the numbers.