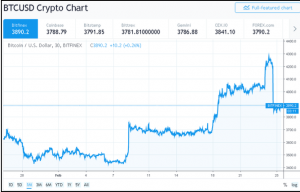

As the old phrase warns us: “What goes up fast, goes down faster.” The crypto markets have once again failed to shed the stigma of extreme volatility. After a little over a week of steady build up in Bitcoin valuations from the mid-$3,500s to sneaking a peak over $4,200, the house of cards suddenly came crashing down. In the space of one hour, BTC lost 9% of its hard-earned recovery, while the entire system shed $17 billion in market capitalization, settling in at $127 billion.

The carnage was so swift that analysts had a difficult time discerning the how’s and why’s of the situation, but satisfy it enough to say that BTC had re-traced back to the 61.8% Fibonacci level of support, a sign that at least some semblance of technical underpinnings were at play. For those that are accustomed to this type of “whiplash” in the crypto markets, this swift wave action may not have come as a surprise, but the reasons for both the rise and the fall were still a mystery to some.

It was only two weeks ago that technical gurus were claiming that Bitcoin would soon pass through $3,000 and head further south to parts unknown. Negative predictions filled the airways, forecasting dire days ahead in the $1,250 and up territory. Many of these pessimistic types are still on this bandwagon, although there are just as many analysts that are certain that there is heavy buying interest in the low $3,000s, a solid level of support in their estimation.

The contention is that “smart money”, i.e., institutional players and wealthy investors, understands the potential over the next few years and will accumulate accordingly whenever dips create buying opportunities. Accumulation was given as the reason back on the 8th of February, when BTC made a nice jump, although the expectation had been that it would drop like a stone. The next step up in valuation was also a surprise, but the accumulation theory did not quite fly with the masses.

The prevailing argument for this “leg” was the anticipation of a “hard fork” in the Ethereum platform, due to take place on the 25th of February. The date had been delayed from January for security reasons, but the actual cutover is tied to a particular block being mined, such that the actual timing could be over this week and next.

In this case, the updates are viewed as positives for the industry and for Ethereum. Process speeds were to mimic the Lightning Network changes at Bitcoin, while modifying the mining process from the “Proof-of-Work” protocol to the more efficient and less costly “Proof-of-Stake” reconciliation method. Back in early November, the industry went chaotic over a Bitcoin Cash “hard fork”, which was more atune to a divorce, a situation that never augurs well. Values plummeted back then. The reverse is true today.

In the current “hard fork” scenario, the reasoning is that investors gradually bought into all cryptos in anticipation of positive outcomes and a more robust system going forward. Along this same vein, however, there are always those traders that “sell-on-the-news” or take their profits and run. The resulting selling pressure from this contingent of traders sparked the sudden “flash crash”, if you buy into this way of thinking.

Analysts, both pessimists and optimists, have pointed to the $4,200 level as serious resistance that must be overcome in a show of strength if Bitcoin is ever to mount a new offensive aimed at the $6,000 to $8,000 territory by the end of this year. The positive takeaway from recent price behavior is that this was but the first test of $4,200. Obviously, the bears are still in control, but the bar has been moved higher, and more tests will come.

As for the swiftness of recent moves, too much money is still sitting on the sidelines, as are traders and investors. More volume on both scores will bring more stability, but until that day, volatility will remain: “Corrections will occur time and time again when crypto assets make rapid gains in short spaces of time. Day traders and scalpers probably love the action but the volatility may still be off-putting for institutional investors seeking more stable gains over a longer period.”

There also needs to be a word said about the amount of money sitting on the sidelines. Insiders claim that clients are waiting for dips. They see the potential of many projects, designed with the institutional investor in mind, coming to fruition in the months ahead. No one is predicting huge swings in market values when Fidelity, Bakkt, ErisX, and the Nasdaq make their initial forays into the industry, but the long-tem implications do bode well for all crypto platforms.

Was this sudden market move a flash crash or a basic correction? Does such a label really matter at this point? Markets tend to rise in steps, with profit-takers giving way to new entrants in the market, a healthy state of affairs. Technicians can see the long-term prospects, but they also see the possibility of a near-term downturn. They could be wrong or right, but for the time being, the chart presented above suggests a positive trend line for the future, if only the bulls will follow through.