Ten years back, Bitcoin may have only been a dream in the minds of software programmers and anti-banking zealots, but, in one short decade, the crypto revolution has morphed into an avalanche of new cryptocurrencies, all aspiring to gain the traction and success of the BTC model. As it turns out, not all token systems focus on the point of sale. At this stage, the investment community has driven volumes sky high, nearly 17.2 billion in a 24-hour period, if you believe the entities that report such data. There is an ongoing debate that exchanges inflate their data for competitive reasons, but big numbers are still, well, big numbers.

Are the other numbers big, too? The number of coin systems is a question on point. One author may quote 1,000, another 1,500. One respected data aggregator, if there really is such a thing, is Coinmarketcap.com. Today, they consolidated data from 14,283 endpoints to arrive at market caps for 2,008 individual crypto entities, but only 1,586 had valuations. On September 28, 2018, the total market cap for the system was $222 billion, actually surpassing the market cap for Proctor and Gamble, which stood at $207 billion. Cryptocurrencies are not stocks. Behavior characteristics are very different.

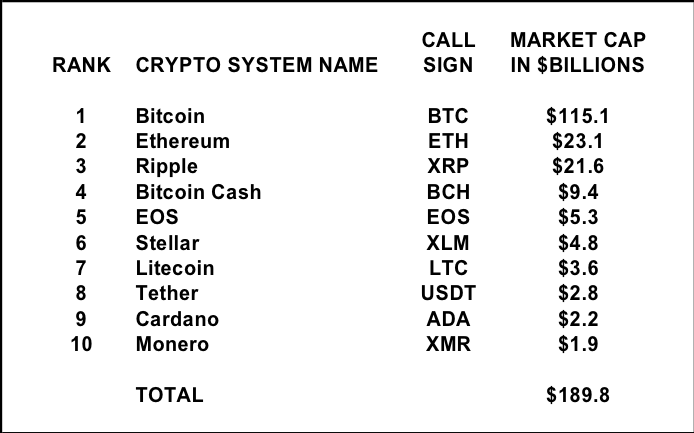

As you might expect at this stage of development, Bitcoin dominates the landscape, accounting for 52% of this total market cap figure. Here is a table for today’s “Top 10” programs. As you will note, value today is concentrated at the top, which represents nearly 86% of the total industry figure of $222 billion:

Daily trading turnover stands at $17.2 billion, but Bitcoin contributes only 30% of this figure, which means that “trending” data is all important to determine which programs are gaining attention and momentum from traders for whatever reason, good, bad, or indifferent. The other takeaway from this concentration theme is that young entrants may gain traction to a degree, but liquidity will always be an issue. Remember that paper profits are nothing until they are cash in the bank. Attempting to sell too large a block at the wrong time could cause prices to plummet. It is also important to note that this industry has already gained a reputation for “Pump-and-Dump” schemes, such that caution, due diligence, and careful study are always advised.

The path to success in trading the cryptocurrency space is no different than any other medium. The words of wisdom from experienced investors are that successful investing in this space is also dependent upon the same three factors as in any other arena – knowledge, experience, and emotional control. Information and education are keys for awareness, but there is no substitute for experience. Practice time on a demo system is an imperative. Even after your preparation phase, you must approach the market in a disciplined fashion. Always have a plan of attack. Know when to buy, but, especially, know when to sell. It may take nerves of steel, but at the end of the day, have fun, too!