One of the first lessons that a forex trader learns is that you must trade “currency pairs”. Each part of that pair may move to the beat of very different fundamental drummers, a tip-off for where to search for high-probability trends in the making. For example, lets assume that global tensions have heated up, a good thing for the USD, but that China is struggling with an economic slowdown, a bad thing for the Aussie or AUD. If these fundamentals were to hold, then shorting the “AUD/USD” currency pair may present the “edge” you need for a positive trading gain over time.

Is there a similar situation in the cryptocurrency trading arena? As a matter of fact, there is. When times get stressed in the forex world, capital flight tends to move about the planet seeking safer havens, i.e., U.S. Treasuries or Gold. Increased demand translates into a rising U.S. Dollar. In a similar fashion, holders of altcoins, if stressed, may transfer their positions to Bitcoins, a crypto “safe haven”, so to speak, and vice-versa, as well.

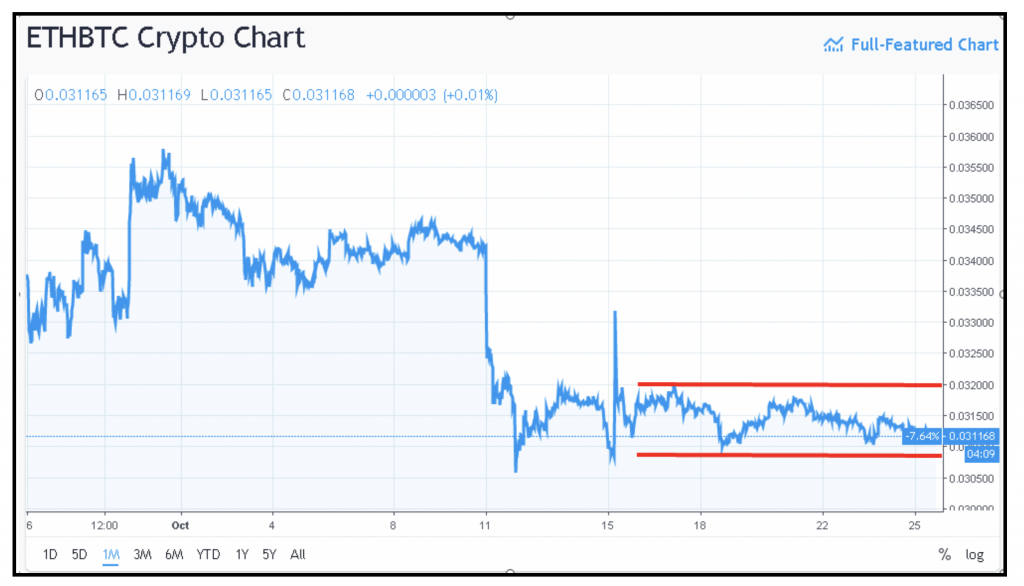

Where do you look to get guidance for this type of situation? The “ETH/BTC” crypto pair is regarded as a risk barometer for crypto market innovations. Let’s take a look at a monthly chart for “ETH/BTC”:

Per one analyst: “Most alternative cryptocurrencies are built on the Ethereum blockchain. The ETH/BTC pair then serves as a good indicator of risk-on/risk-off sentiment, that is, rising ETH/BTC means risk-on and falling ETH/BTC means risk-off. A risk-on period is characterized by an increased demand for high-risk cryptocurrencies. Therefore, during risk-on BTC tends to depreciate against ETH and other altcoins as fiat money tends to flow into cryptocurrency markets via major assets like BTC and is then rotated into alternative cryptocurrencies.”

Recently, global stock markets have been in turmoil. Veterans have stated that a mild correction is taking place, a healthy step after two years of unbridled growth. Investors, however, have been quite edgy, wondering whether a major correction was just around the corner. Panic tends to lead to capital flight, but it, amazingly enough, has not sent cryptocurrencies into a downward death spiral, as many have predicted. Quite to the contrary, Bitcoin and Ethereum prices have held firm, actually range bound, as indicated by the two parallel red lines on the chart.

For the time being, no one is racing for the exits in the crypto space, but another lesson from the forex trading world is that “currency pairs” do not range forever. At some point, there will be a breakout, as you may note happened back on the 11thof the month, although industry analysts claimed that BTC spiked when owners of Tether tokens abruptly switched their positions to Bitcoin on that fateful day. There is also another corollary to remember: The longer the ranging period, the bigger the breakout.

If you are into trading inter-crypto pairs, then keep these lessons and rules in mind, and be sure to keep tabs on the “ETH/BTC” chart. It is your best gauge of risk sentiment in the cryptocurrency market.