Have the winds of Crypto Winter done their dash, or must we endure more pain and sorrow in Crypto-Land until it passes? Crypto enthusiasts have grown weary of a winter that seems to have no end, but the recent upswing and stability of Bitcoin prices has sent a jolt through the community that, perhaps, better times are ahead and that the worst is truly behind us.

During these recent bleak times, Bitcoin lost 79% of its value, while its altcoin brethren were punished by even greater losses that were in excess of 90% in some instances. Mining operations have cut back or been shuttered. The same has been true for crypto exchanges. Five firms have already called it quits in 2019. Optimists have been few and far between, while skeptics blasted away, claiming that Crypto Winter was far from over. Their forecast: Bitcoin would fall below $2,000 before it ever formed a firm bottom.

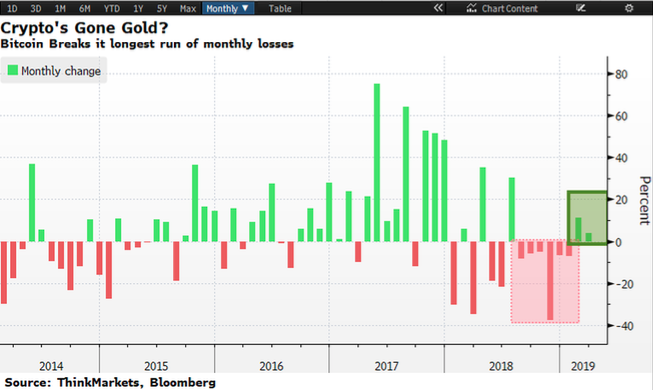

But something changed when 2019 rolled around. Yes, January was like previous months, but prices never hit the low point established in December of $3,130. The month of February was stellar, the first positive return month, since July of 2018, and for all intents and purposes, March after two weeks looks like a repeat performance.

Not only have gains been reported on a monthly basis, but volumes have also returned, a good indication that bulls have come out of their caves to battle it out with the bears. Another major point in Bitcoin’s favor is that it has already tested the vaunted psychological level of $4,000 not one, not two, but already three times this year, and it has not backed down significantly after each assault. A firm bottom seems to be forming, and a stronger case can also be made due to the fact that the bearish losing streak from last July has finally been broken.

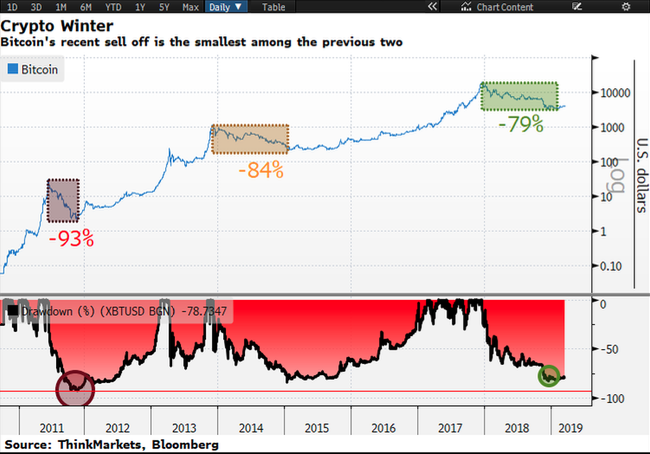

Of course, cynics have not disappeared into the woodwork. They are still in abundance and expect that a precipitous fall is still imminent. These nay-sayers are quick to produce technical charts that support their propositions, but the new twist is that crypto supporters now have charts that purport just the opposite. The following chart is but one example of what is being bandied about to provide evidence that BTC has turned a corner, once and for all:

As the chart depicts, the recent sell-off, i.e., Crypto Winter, was the smallest among the three major pullbacks so noted: 79% versus 84% and 93%. Yes, the amounts were much larger from a dollar value this time around. The mania of 2017, where traditional investors suddenly became aware of the major gains being had in the crypto space, threw conscience to the winds, and allowed “FOMO”, the fear of missing out, to replace good judgment and basic common sense, was clearly unsustainable.

Most all of these investors are sitting on the sidelines and licking their wounds, but value investors and institutional players have not given up on the space. They recognize the mistakes of the past and understand that Bitcoin is here to stay and represents value in the long term. Their only issue is at what point should they choose to participate. There have already been several articles that suggested that these investors have been buying on the “dips”, whenever prices hit the lower $3,000s. A great deal of recent support, if you buy into this argument, is that an accumulation phase is silently underway.

Bitcoin prices today are steady at $3,995, but back on March 4, they set a low for the month of $3,671. Prudent investors know that attempting to buy at an absolute bottom is a foolish exercise. They are willing to pay a small premium above the low to establish their long-term hold positions, but they also want to keep this premium at a minimum. For those savvy investors that bought at the beginning of February, gains to date have been in the 18% and up ballpark, much better than with equities. The S&P 500 index appreciated a mere 5% over the same time period.

A basic Bitcoin price chart also provides more technical support that the current situation is not temporary, but could herald that better times are on the near-term horizon. Here is one without logarithmic scaling, which many analysts have used to support their guesses at future pricing behavior:

A technician would say that Bitcoin prices rebounded off support provided by the 200-Day Moving Average, denoted in Yellow, which provides a comfortable boundary at the $3,400 level, but the story gets interesting when and if the 200-Day MA catches up with the 50-Day MA in Pink, which is on a descending path. This storyline is what prompts the optimistic group of analysts to project good things, perhaps, only a few months away.

Many analysts have already predicted that BTC will crash right through the $5,000 mark in May, and if that happens, then all bets are off for the future – anything is possible at that point. Liquidity is tightening again, which could fuel a major move if demand were to spike at any time. According to Heslin Kim, VP of business development at Polymath: “Liquidity in this market is sparse and has dried up in many exchanges. I think we can all agree this is a good thing, if temporary.”

Technical charts are one thing, but in a nascent industry where volumes are spread over a hodge-podge network of unregulated exchanges, technical analysis is limited in how accurately it can truly gauge investor sentiment and psychology. Yes, trading robots will pick up on obvious patterns and key benchmarks for support and resistance, but at the end of the day, fundamental forces are what drive market action.

From a fundamental perspective, there has been no shortage of positive articles in the financial press about cryptocurrencies, blockchain technology, and efforts by large institutional players to make inroads into the crypto mainstream. Household names like Facebook, IBM, Samsung, Google, Fidelity Investments, the Nasdaq, and pet investment projects of the group like the Bakkt and ErisX crypto exchanges, can only add fuel to the investment fire that is building in the background. The “smoke” is attracting a segment of the investor community that can only see good things happening over the long term and prefers to act before the “herd” catches onto the trend to come.

Dr. Stef Savanah, a blockchain researcher and avid patent file with over 100 patent applications in his name alone, was recently asked for his take on the current situation: “2018 saw a much-needed correction in a market driven by speculation, misused ICOs, and gross misunderstanding of appropriate blockchain usage. The recent stabilization in bitcoin prices heralds a return to prudence. 2019 will see the original bitcoin vision re-emerge with killer applications, such as properly implemented asset tokenization.”

Has Crypto Winter finally come to a close and are Bitcoin prices about to spring forward? There are plenty of folks on both sides of this equation that believe in their own analysis of the situation and who will vehemently argue their case, whether up or down. The fact is, however, that there has not been this much positive evidence supporting a change in momentum for all things crypto in quite some time. Both groups, however, cannot be right, but Bitcoin enthusiasts seem to be holding their heads a bit higher these days.